What is a Rolling SAFE?

A continuous programmable equity offering

As we saw in the previous section, raising money can be tedious and can consume a lot of time and energy for founders. A successful startup may have to go back to investors for additional funding to keep growing, sometimes several times over a short period of time. Founders have a new tool at their disposal to raise capital. One that makes the process easier is even better.

Just as in its time, the classic Simple Agreement for Future Equity (SAFE) supplanted the convertible note, the Rolling SAFE is intended to be an upgrade to SAFEs. It uses blockchain technology and tokenization to programmatically control the offering process of so-called programmable equity and offer transparency. It automates some of the SAFE mechanisms and replaces others. It also helps founders to promote their raise directly to their community through their website.

A Rolling SAFE is designed to simplify the asset-raising process in comparison with a traditional SAFE or a convertible note. However, both, traditional SAFEs and convertible notes, are usually used to facilitate a seed round - the triggering event often being a series A raise. In theory, a founder could use a Rolling SAFE to take care of the entire venture capital asset-raising process. The founder simply sets the triggering event as any of the classic exit strategies normally looked for by an investor: a trade sale, secondary market buyout, or IPO.

A Rolling SAFE can stay open continuously for investment using clearly and transparently stated terms. This means anyone can invest at any time. The company no longer needs to either raise capital in multiple rounds or renegotiate multiple SAFEs. As the Rolling SAFE is governed by a smart contract, it can automatically change predetermined parameters as funds flow into its treasury effectively changing the implied valuation of the company over time. As more capital is raised, the company valuation increases automatically, benefitting early investors.

Rolling SAFE properties

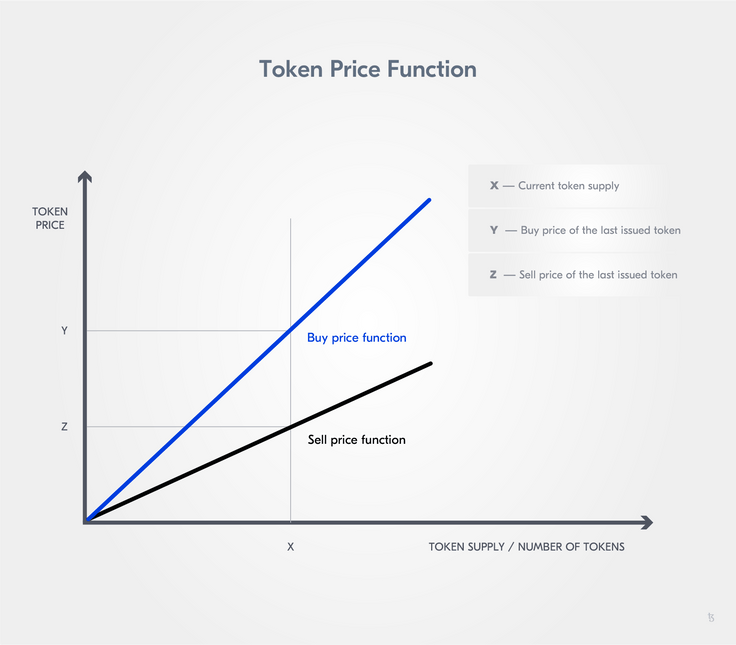

Thanks to the use of bonding curves, a Rolling SAFE can have the following properties:

- Unlimited token supply: There is no theoretical limit to the number of Rolling SAFE tokens that can be minted, i.e. generated;

- Predictable: The buy and sell prices of Rolling SAFE tokens increase and decrease in line with the number of Rolling SAFE tokens minted or burned;

- Linear: The price of the second Rolling SAFE token minted (the value

n) is less than the third Rolling SAFE token minted (i.e.n+1) and more than the first Rolling SAFE token minted (i.e.n-1); - Liquid: Rolling SAFE tokens can be immediately bought or sold at any time. After the lock-up period expires, the bonding curve acts as an automated market maker. The smart contract (i.e. DAT) acts as the counterparty for the transaction and needs to always hold enough in the reserve to buy Rolling SAFE tokens back.

The Rolling SAFE also has the provision to reward key stakeholders. Founders can reserve an equity allocation for users, customers, partners, employees, community members, etc. This can all be done under the Rolling SAFE rather than having to create and administer a separate scheme.

Why would an investor be interested to invest in a startup via a Rolling SAFE?

Here we meet the two main categories of investors: individual investors (angels, friends, and family) and venture capital (VC) firms.

Individual investors are accustomed to sourcing their investments through word of mouth, email lists, crowdfunding platforms, or angel networks. They might find a natural advantage with the Rolling SAFE as they can have access to it from the moment they encounter the company's capital raising website. At this point, they can start doing their due diligence with the information provided by the startup, and quickly decide if they want to invest or not. The discovery process and investment opportunity are bundled together making the overall process smooth and straightforward.

For VC firms, who need to report to their investors and who usually manage larger portfolios of investments, a benefit comes from a new function offered by the Rolling SAFE: the secondary market. By providing liquidity for this type of investment it allows VC firms to revisit regularly which companies to keep, remove, or add to their portfolio. This allows VC firms to efficiently redeploy capital and maintain their risk/reward ratios.

Local tax and securities regulations are key elements to investigate for any startup looking into issuing a Rolling SAFE. No startup should use this type of instrument before receiving comprehensive legal advice.

Stages in a Rolling SAFE

For ease, a Rolling SAFE's lifecycle can be split into four stages:

- Initialization,

- Pre-Minimum Funding Goal (MFG),

- Post-MFG, and

- Termination.

Let us now have a closer look at the different stages of a Rolling SAFE.

Initialization

During the initialization, the issuer (i.e. the company) decides on the terms of the offering by defining a few key parameters:

- The initial valuation, which is effectively a valuation floor - the minimum amount the issuer is prepared to value the company (post-money) to accept an investment,

- The percentage of the company's equity it would like to offer to external investors,

- The initial price per Rolling SAFE token, and therefore, the number of Rolling SAFE tokens the company wants to issue,

- A ticker name to the Rolling SAFE token (e.g. "TZM"),

- A target minimum amount of capital to be raised, the minimum funding goal (MFG),

- The portion of funds raised that will be kept in the reserve and its currency denomination (i.e. base currency), usually a stablecoin,

- The length of the lock-up period, so to say the minimum period the investor must hold their Rolling SAFE tokens before being allowed to sell them via a secondary market,

- The minimum investment amount the company is prepared to take from a single investor, and

- The termination event list, which normally includes an IPO, sale, and bankruptcy.

The base currency is usually a stablecoin, e.g. a wrapped USDC (wUSDC) or a chain native stablecoin like EURL.

Pre-MFG

The issuer set a target amount of capital to be raised, a minimum funding goal (MFG). As long as this target is not met the Rolling SAFE remains in the Pre-MFG stage. In this phase, all Rolling SAFE tokens are offered at the same price (i.e. the initial price) and all stablebcoins received through the Rolling SAFE token sale are escrowed by the DAT.

Before reaching the MFG, the offering can be canceled by the company at any time and investors get their money back.

Post-MFG

Once the MFG is reached, the offering can no longer be canceled but only closed (i.e. terminated) by a liquidity or dissolution event.

A defined portion of the stablecoins moves into the reserve and the other portion goes to the company to run the business. Typically, the reserve holds a large proportion of the stablecoins. Crucially, the Rolling SAFE token price is no longer fixed but is now determined by a bonding curve.

During this phase, investors can buy and sell their Rolling SAFE tokens. The buy and sell price of the Rolling SAFE tokens are calculated automatically with the bonding curve. The post-MFG buy price is based on a function of the number of Rolling SAFE tokens issued; as more Rolling SAFE tokens are issued, the implied valuation (i.e.) increases.

In Rolling SAFE sample web application:

- The

buy()function implements a linear relationship between the buy price and the number of Rolling SAFE tokens, and - The sell price is determined by the value of the stablecoins in the reserve. If an investor sells their Rolling SAFE token back to the DAT, they receive a commensurate portion of the stablecoins in the reserve.

While the offering is active, investors can buy and sell Rolling SAFE tokens to others or sell them directly back to the DAT.

Termination

Rolling SAFEs are closed either due to a liquidity or a dissolution event. For example, when the company is sold or goes public with an IPO, the liquidity event leads to the offering ending and investors being entitled to receive the proceeds of the sale in stablecoins, which is equivalent to the equity value represented by the investor's Rolling SAFE token holding at the time of the sale. Importantly, investors do not receive company equity but the proceeds of the equity, investors never actually hold the company equity for regulatory reasons.

To officially terminate a Rolling SAFE in case of a liquidity event, a number of things need to happen:

- The issuer pays an exit fee to the DAT. The exit fee is equal to the current issuance price of Rolling SAFE tokens multiplied by the number of outstanding Rolling SAFE tokens, minus the value of the stablecoins held in reserve by the DAT;

- The DAT then buys back the Rolling SAFE tokens with the stablecoins from the exit fee and the reserve. Which, of course, equals the current issuance price of the Rolling SAFE tokens.

A dissolution event is one where the company ceases trading and is wound up, either voluntarily or involuntarily. Depending on the assets still available in the company, the maximum amount an investor can expect is the purchase price of their Rolling SAFE tokens, while the minimum is nothing. The investors have a claim on a par with any other SAFEs and/or preferred stock.

Functions of a Rolling SAFE

The Rolling SAFE has three key functions that govern the buy and sell price:

buy()functionsell()function, andburn()function.

The buy() function is called by the investor to buy the Rolling SAFE Tokens from the DAT. The DAT issues new Rolling SAFE tokens in proportion to the investment amount received. The DAT keeps a portion of the funds in the reserve.

The sell() function is called by the investor to sell their Rolling SAFE tokens. The DAT burns them and sends back the corresponding amount of stablecoins held by the reserve to the investor as payment.

The burn() function burns tokens. These burned Rolling SAFE tokens become unusable and their value is redistributed among the remaining investors through a Rolling SAFE token price increase. As burning tokens does not technically destroy them, the total amount of tokens issued is not affected.

In blockchain, coin or token burning is not an unusual thing. Burning is done to take tokens out of circulation. Often this happens by sending a token intentionally to an unusable wallet address (i.e. burn address). The address is unusable because it cannot be accessed by or assigned to anyone.

Note: Since in the TZMINT web application the issuer mints its Rolling SAFE tokens, there is no need for a burn address.

Now that we understand the funding mechanism, let us jump into the System Architecture and Data Handling side of things.

- Celia Wan (2020): DeFi Start-up Launches Platform That Lets People Invest in Start-up Revenue Instead of Equity

- Cooper Turley (2020): Introducing Continuous Security Offerings by Fairmint

- Fairmint Inc. (2021): A New Era of High Resolution Fundraising: The Rolling SAFE

- Fairmint Inc.: Rolling SAFE

- Fairmint Inc.: Template for a Continuous Agreement for Future Equity

- FundersClub: What is a SAFE?

- Joshua Stoner (2020): Fairmint Launches with High Hopes for the 'Continuous Securities Offering (CSO)''

- Marko Vidrih (2020): Continuous Security Offering (CSO) — A New Type of Financing

- Thibauld Favre (2019): Continuous Organizations Whitepaper

- Thibauld Favre (2020): Introducing the Continuous Securities Offering Handbook