Smart Contract Implementation I

Implementing the buy function

B9lab's sample project is an implementation of a continiuous programmable equity offering also known as a Rolling SAFE. To see the implementation in action, please visit the TZMINT web application hosted by B9lab. It is better to first try out the web application before taking a closer look at the implementation described in this course.

For a close look at the formulas used for calculation, we recommend consulting the Continuous Organizations Whitepaper by Thibauld Favre. In this section, we present an implementation of the whitepaper's ideas, our TZMINT project.

We implemented our smart contract in SmartPy. The tokens are represented as a simple map to keep things simple. In addition, we store everything we want to keep track of on-chain:

self.init(

organization = organization, # contract administrator

ledger = sp.map(l = {organization: sp.as_nat(preminted)}), # token ledger

price = initial_price, # initial price before MFG

total_tokens = preminted,

burned_tokens = burned_tokens,

MFG = MFG, # minimal funding goal

MPT = sp.timestamp(...), # minimum period of time

# percentage of the funds being held in the cash reserve

funds_ratio_for_reserve = funds_ratio_for_reserve,

# percentage of the revenues being funneled into cash reserve

revenues_ratio_for_reserve = revenues_ratio_for_reserve,

buy_slope = buy_slope,

sell_slope = sell_slope,

minimumInvestment = minimumInvestment,

company_v = company_valuation,

base_currency = base_currency,

total_allocation = total_allocation,

stake_allocation = stake_allocation,

termination_events = termination_events,

govRights = govRights,

company_name = company_name,

phase = 0, # starting under MFG

total_investment = sp.tez(0)

)

Need a recap on SmartPy? No worries! We recommend a look at the chapter Writing Smart Contracts in this course.

Contract entrypoints

The contract has five entrypoints:

buy(),sell(),pay(),burn(), andclose().

In this section, we begin with an explanation of the buy() and pay() functions. Afterwards, in the next section, we will talk about the sell() and close() functions, also known as closing function.

You can find the smart contract in the project's GitHub repository.

If you want to extend this smart contract to, for example, fulfill the FA2 token standard, you will need to implement additional entrypoints. You can find more information on the token standard in the FA2 section.

The buy() function

buy() calculates the number of tokens for the sent amount of tez and it mints these tokens. In addition, it should send back the excess amount.

There are two phases in the offering regarding the buy price:

- The initial phase: Before the minimum funding goal (MFG) is reached, the buy price is constant;

- The slopy phase (i.e. post-MFG phase): Once the MFG is reached, the buy price increases for each issued token.

Entrypoint

Let us first have a look at the buy() entrypoint and understand the conditions for calling the initial or slope buy function:

# buy some tokens with sender's tez

@sp.entry_point

def buy(self):

#check the phase, dont sell or buy if closed

sp.if self.data.phase != 2:

# if token in intialization phase, the price is fixed and all funds are escrowed

sp.if self.data.total_investment < self.data.MFG:

# check the excess above MFG and send back

sp.if sp.utils.mutez_to_nat(self.data.MFG - sp.amount - self.data.total_investment) < 0:

sp.send(sp.sender, sp.amount - self.data.MFG + self.data.total_investment)

self.buy_initial(self.data.MFG - self.data.total_investment)

sp.else:

self.buy_initial(sp.amount)

# if initialization phase is past

sp.else:

self.data.phase = 1

self.buy_slope(sp.amount)You can see that we do not allow any action to take place after the closing phase.

We check for excess in two different instances:

- The excess in the

buy()function, and - The excess in the

buy_initialandbuy_slopefunction.

The excess check in the buy() function makes sure that a buy transaction does not surpass the MFG. The excess in the buy_initial and buy_slope function calculates the excess amount of tez after a buy transaction, so to say, your change.

Initial phase - Pre-MFG

The buy price is determined during the initial phase by the following lines in the contract code:

# initial phase, the price is fix

def buy_initial(self, amount):

# calculate amount of tokens from sp.amount and the price

token_amount = sp.local(

"token_amount",

sp.ediv(

amount,

self.data.price

).open_some("Fatal Error: Price is zero")

)In this phase, the calculation is token_amount = amount/self.data.price, where amount represents the number of tokens (in tez) sent with the transaction and self.data.price is the current price of the token.

After the calculation, buy_initial checks if any tokens can be issued. Then it adds the calculated number of tokens to the ledger linking them to the transaction sender. In case no record of the user exists, it creates an entry. The comments in the code should suffice as an explanation:

# fail if no tokens can be issued with this amount of tez

sp.if sp.fst(token_amount.value) == sp.as_nat(0):

sp.failwith("No token can be issued, please send more tez")

# check if the address owns tokens

sp.if self.data.ledger.contains(sp.sender):

# add amount of the tokens into the ledger

self.data.ledger[sp.sender] += sp.fst(token_amount.value)

sp.else:

# put amount of the tokens into the ledger

self.data.ledger[sp.sender] = sp.fst(token_amount.value)

# increase total amount of the tokens

self.data.total_tokens += sp.fst(token_amount.value)

# keep received funds in this contract as buyback reserve

# but send back the excess

sp.if sp.utils.mutez_to_nat(sp.snd(token_amount.value)) > 0:

sp.send(sp.sender, sp.snd(token_amount.value))

# track how much is invested

self.data.total_investment = self.data.total_investment + amount - sp.snd(token_amount.value)Before calculating the recent value of the total investments, the excess is calculated and sent back to the user.

Post-MFG phase

Now, let us have a look at the post-MFG phase, so to say the "slopy phase" for the buy() function.

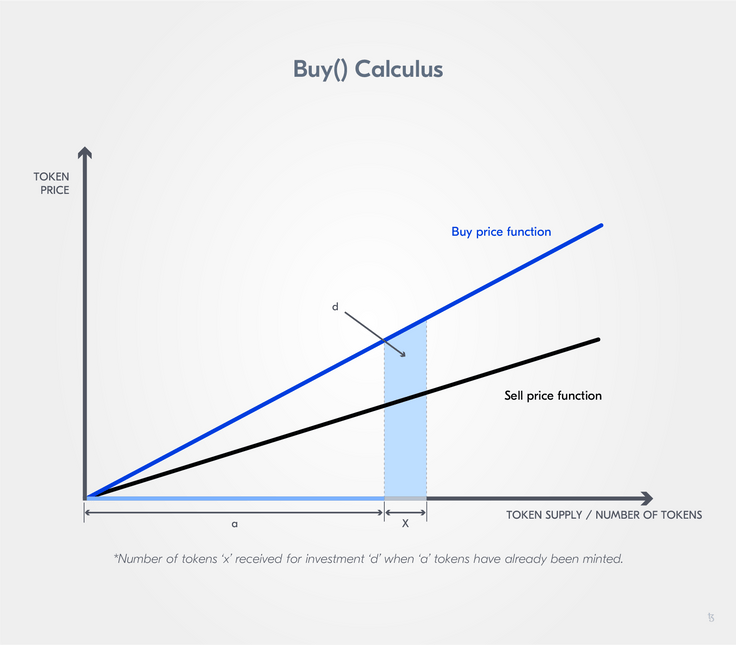

This time the calculation for the token_amount is more complex because of the linear price increase. We have to calculate the area of the trapezium under the price function.

Next, the contract does a reserve calculation to determine the amount of the excess, which has to be sent back to the transaction sender. In addition, each time someone buys a token, a part of the tez amount in the transaction is kept for the buyback reserve:

# after initial phase, the price will increase

def buy_slope(self, amount):

# calculate amount of tokens from amount of tez

# see https://github.com/C-ORG/whitepaper#buy-calculus

token_amount = sp.local(

"token_amount",

self.square_root(

2 * sp.utils.mutez_to_nat(amount) /self.data.buy_slope +

self.data.total_tokens * self.data.total_tokens

) - self.data.total_tokens

)

tez_amount = sp.local(

"tez_amount",

sp.as_nat(token_amount.value) * self.data.total_tokens * self.data.buy_slope/2 +

(sp.as_nat(token_amount.value) + self.data.total_tokens) * sp.as_nat(token_amount.value) * self.data.buy_slope/2

)

send_back = sp.local(

"send_back",

amount - sp.utils.nat_to_mutez(tez_amount.value)

)

# send tez that is too much

sp.if sp.utils.mutez_to_nat(send_back.value) > 0:

sp.send(sp.sender, send_back.value)

# track how much is invested

self.data.total_investment += sp.utils.nat_to_mutez(tez_amount.value)

# fail if no tokens can be issued with this amount of tez

sp.if sp.as_nat(token_amount.value) == sp.as_nat(0):

sp.failwith("No token can be issued, please send more tez")

# calculate buyback reserve from amount I*amount/100

buyback_reserve = sp.local(

"buyback_reserve",

sp.utils.nat_to_mutez(self.data.I * tez_amount.value / sp.as_nat(100))

)

company_pay = sp.local(

"company_pay",

amount - buyback_reserve.value

)

# send (100-I) * amount/100 of the received tez to the organization

sp.send(self.data.organization, company_pay.value)

# this will keep I * amount/100 in this contract as buyback reserve

# check if the address owns tokens

sp.if self.data.ledger.contains(sp.sender):

self.data.ledger[sp.sender] += sp.as_nat(token_amount.value)

sp.else:

self.data.ledger[sp.sender] = sp.as_nat(token_amount.value)

# increase total amount of the tokens

self.data.total_tokens += sp.as_nat(token_amount.value)

# set new price

self.data.price = sp.utils.nat_to_mutez(self.data.buy_slope * self.data.total_tokens)

self.modify_sell_slope(send_back.value + company_pay.value)At the end of a buy_slope call, the contract updates the sell slope. This is something we address in the next section.

The pay() function

A user can call the pay() entrypoint to send a payment to the organization via the smart contract. If pay() is called, the smart contract issues new tokens and by default sends them to the organization.

We allow payments in the slopy phase:

@sp.entry_point

def pay(self):

# check that the initial phase is over but not closed

sp.verify(self.data.phase == 1)

# see https://github.com/C-ORG/whitepaper#-revenues---pay

buyback_reserve = sp.local(

"local_amount",

sp.utils.nat_to_mutez(

sp.utils.mutez_to_nat(sp.amount) * self.data.revenues_ratio_for_reserve / 100

)

)

# send sp.amount - buyback_reserve to organization

amount_to_sent = sp.amount - buyback_reserve.value

sp.send(self.data.organization, amount_to_sent)

# create the same amount of tokens a buy call would do

token_amount = sp.local(

"token_amount",

self.square_root(

2 * sp.utils.mutez_to_nat(amount_to_sent) /self.data.buy_slope +

self.data.total_tokens * self.data.total_tokens

) - self.data.total_tokens

)

# give those tokens to the organization

self.data.ledger[self.data.organization] = sp.as_nat(token_amount.value)

# increase total amount of the tokens

self.data.total_tokens += sp.as_nat(token_amount.value)You can see, it mints the same number of tokens as if buy() would have been called. A part of the tez sent with the call is kept in the contract:

# send sp.amount - buyback_reserve to organization

amount_to_sent = sp.amount - buyback_reserve.value

sp.send(self.data.organization, amount_to_sent)Let us now take a look at the sell() function.